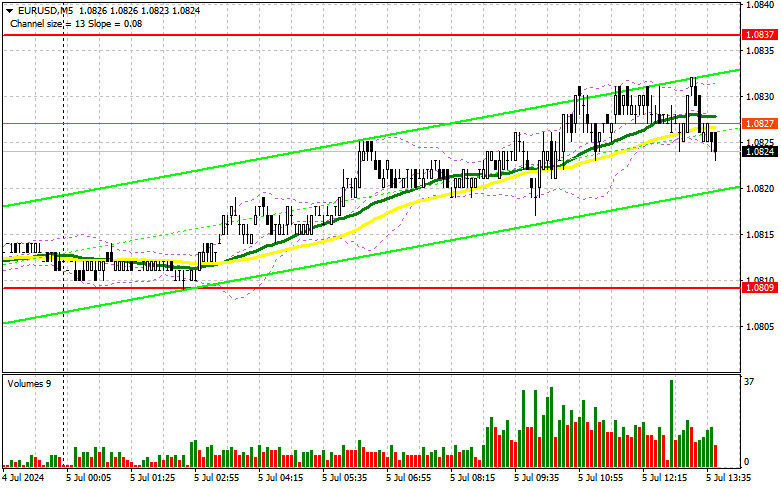

In my morning forecast, I focused on the level of 1.0837 and planned to make market entry decisions based on it. Let's look at the 5-minute chart and analyze what happened. The pair did rise, but it didn't reach 1.0837, which did not allow for suitable entry points into the market. The technical picture still needs to be revised for the second half of the day.

To open long positions on EURUSD:

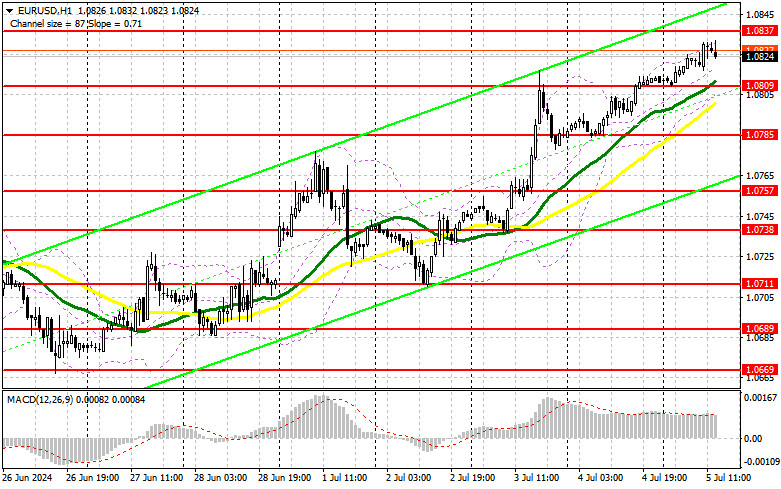

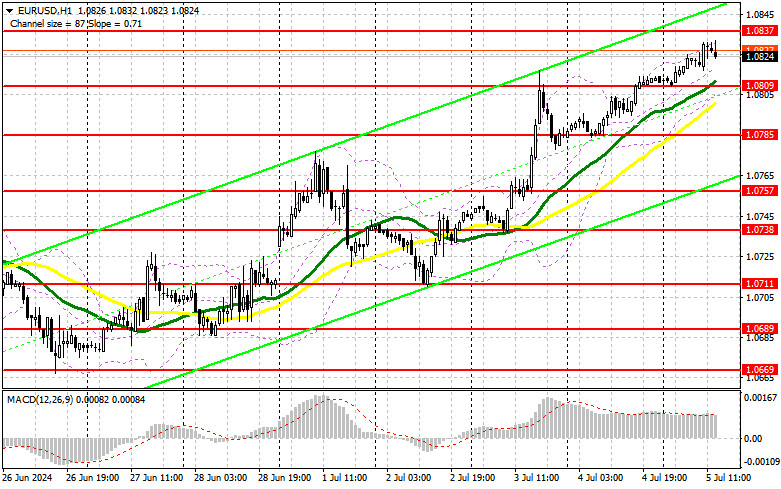

It is evident that statistics from the Eurozone helped continue the growth, but now everything depends on the reports related to the US labor market. Data on unemployment and the change in non-farm employment are expected. Problems may arise precisely with the latter indicator. June figures could be almost half of May's, leading to a dollar sell-off and further strengthening of the euro. If the data surprises everyone again and there is an increase in average hourly wages, demand for the dollar will likely return by the end of the week. For this reason, it's better to operate within the sideways channel. A decline and formation of a false breakout at 1.0809 will be a suitable entry point for long positions targeting a recovery of the euro towards 1.0837 – the new weekly high. A breakout and top-down update of this range will lead to strengthening the pair with a chance to rise to the resistance at 1.0866. The farthest target will be the maximum at 1.0899, where I will be making a profit. Testing this level will allow continuing the bullish trend. If EUR/USD declines and there's no activity around 1.0809 in the second half of the day, I will consider entering only after forming a false breakout around the next support at 1.0785. I plan to open long positions right off the rebound from the minimum at 1.0757, targeting an upward correction of 30-35 points within the day.

To open short positions on EURUSD:

Sellers are quick to re-enter the market, which is understandable. Important labor market statistics always lead to a strong surge in volatility. Only strong data combined with a false breakout around 1.0837 will provide a suitable entry point for short positions with the target of the pair falling to the support at 1.0809, where the moving averages, favoring the bulls, are located. A breakout and consolidation below this range, followed by a bottom-up retest, will give another selling point with a move towards the 1.0785 low, where I expect to see more active buying of the euro. The farthest target will be the area of 1.0757, where I will be making a profit. In the case of an upward movement in EUR/USD in the second half of the day and the absence of bears at 1.0837, which is quite likely, buyers will be able to push the pair higher. In this case, I will postpone sales until testing the next resistance at 1.0866. I will also sell there, but only after an unsuccessful consolidation. I plan to open short positions immediately on a rebound from 1.0899 with the aim of a downward correction of 30-35 points.

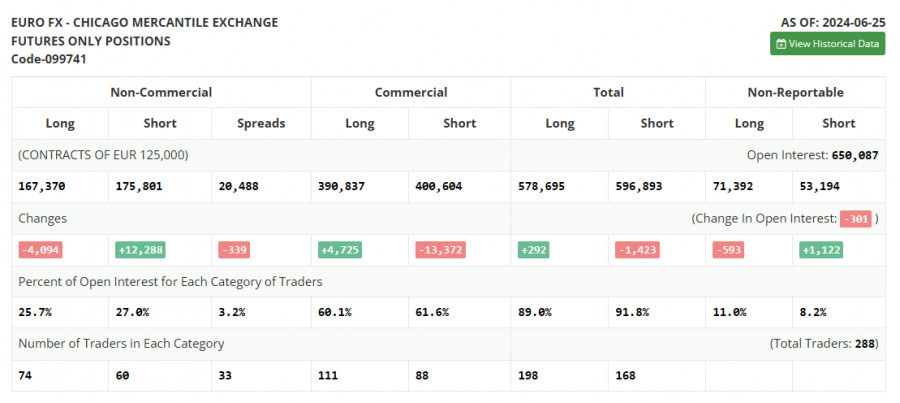

In the COT report (Commitment of Traders) for June 25, there was an increase in short positions and a decrease in long ones. It is evident that the policies of the Federal Reserve and the European Central Bank continue to impact risk assets, and the fact that no changes are expected soon will continue to strengthen the dollar. The COT report shows that long non-commercial positions decreased by 4,094 to 167,370, while short non-commercial positions increased by 12,288 to 175,801. As a result, the spread between long and short positions decreased by 339.

Indicator Signals:

Moving Averages

Trading is conducted above the 30 and 50-day moving averages, indicating a possible growth in the euro.

Note: The period and prices of the moving averages are considered by the author on the hourly H1 chart and differ from the general definition of classic daily moving averages on the D1 daily chart.

Bollinger Bands

In case of a decline, the lower boundary of the indicator, around 1.0809, will serve as support.

Indicator Descriptions:

- Moving average (determines the current trend by smoothing volatility and noise). Period – 50. Marked in yellow on the chart.

- Moving average (determines the current trend by smoothing volatility and noise). Period – 30. Marked in green on the chart.

- MACD Indicator (Moving Average Convergence/Divergence). Fast EMA – period 12. Slow EMA – period 26. SMA – period 9.

- Bollinger Bands. Period – 20.

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain criteria.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open positions of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.