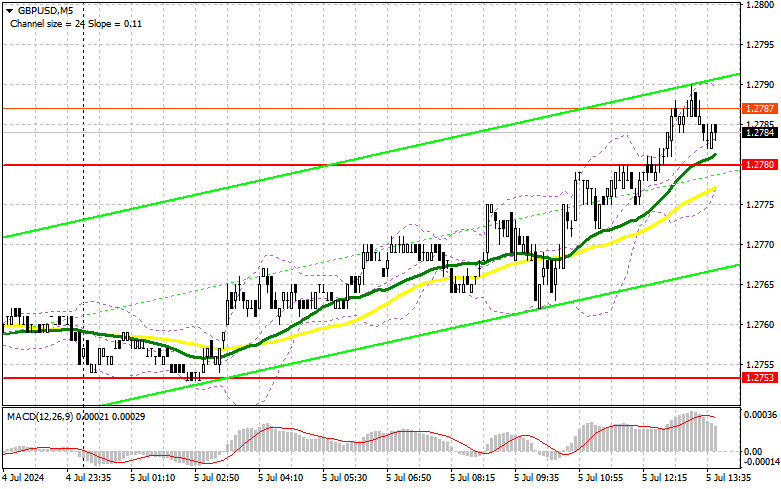

In my morning forecast, I highlighted the level of 1.2780 and planned to make trading decisions from it. Let's look at the 5-minute chart and see what happened. The rise occurred, but the false breakout at 1.2780 did not form, preventing entry into short positions. There were also no opportunities to buy, as we didn't see a retest. The technical picture was revised for the second half of the day.

To open long positions on GBP/USD:

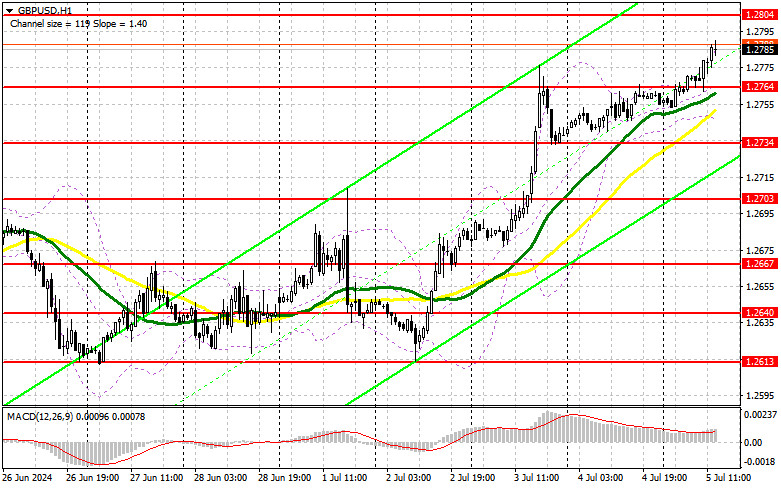

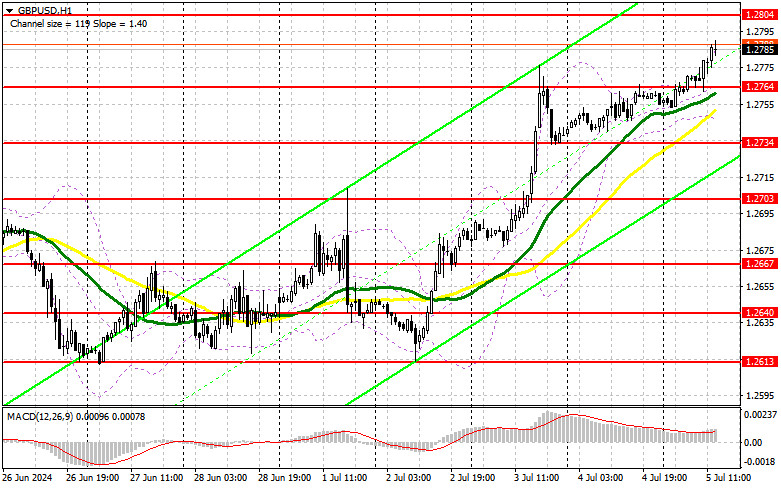

The absence of UK statistics allowed the growth to continue, giving bulls a chance to reach a new weekly high, which they eagerly took advantage of. Now that the technical picture has been revised and with very important US statistics ahead, I will act with extreme caution. Strong data on unemployment and an increase in non-farm payrolls in the US will put pressure back on the pair, leading to a retest of the 1.2764 support, slightly below the moving averages, favoring the bulls. Active defense of this support with a false breakout will provide a good entry point for long positions with the prospect of updating the new weekly high of 1.2804. A breakout and retest of this range from top to bottom will strengthen the pound's upward potential, leading to an entry point for long positions with the possibility of updating 1.2828. The furthest target will be the area of 1.2858, where I plan to take profit. In the scenario of a decline in GBP/USD and the absence of bullish activity at 1.2764 in the second half of the day, pressure on the pair will increase at the end of the week. This will also lead to a decline and an update of the next support at 1.2734, increasing the chances of a bearish correction. Therefore, only a false breakout will be a suitable condition for opening long positions. I plan to buy GBP/USD immediately on a rebound from the low of 1.2703 with the target of a correction of 30-35 points within the day.

To open short positions on GBP/USD:

Sellers failed to make an impact in the first half of the day, so now the focus shifts to defending the new resistance at 1.2804. This level is likely to be tested if the US labor market data turns out to be very weak. Only the formation of a false breakout will be a suitable option for opening short positions with the target of a decline to the support at 1.2764, where the moving averages, which are on the side of the bulls, are located. A breakout and a retest of this range from the bottom up, supported by strong US data, will deal a blow to buyers' positions, leading to stop-loss orders being triggered and opening the way to 1.2734. The farthest target will be the area of 1.2703, where I will be making a profit. Testing this level will significantly harm the pound's upward potential. If GBP/USD rises and there is no activity at 1.2804 in the second half of the day, which is more likely, buyers will have a chance to continue the growth at the end of the week. In this case, I will delay selling until a false breakout at 1.2828. If there is no downward movement, I will sell GBP/USD immediately on a rebound from 1.2858, but only in anticipation of a 30-35 point correction within the day.

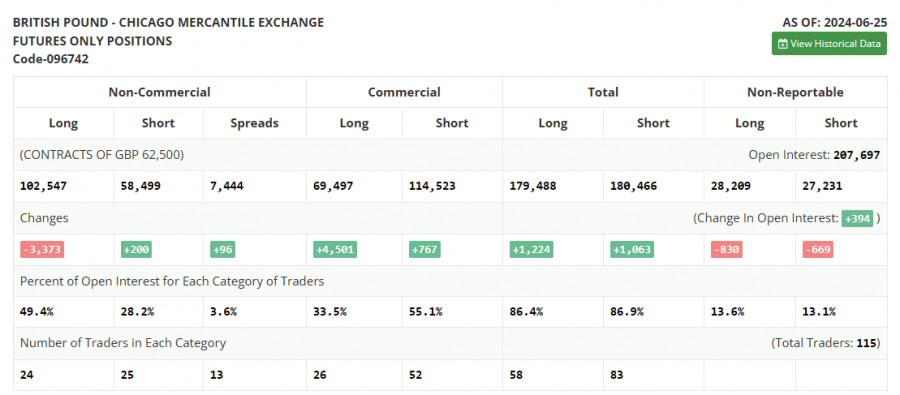

In the COT report (Commitment of Traders) for June 25, there was an increase in short positions and a decrease in long positions. Recent comments from Bank of England representatives about future policy and a possible rate cut in August this year continued to put pressure on the pound. Incoming economic statistics also leave much to be desired, and the pound reacts negatively each time. Apparently, in the reality of the Federal Reserve's firm stance, demand for the dollar is likely to remain, and the pound will continue to fall. The latest COT report states that long non-commercial positions fell by 3,373 to the level of 102,547, while short non-commercial positions increased by 200 to the level of 58,499. As a result, the spread between long and short positions increased by 96.

Indicator Signals:

Moving Averages:

Trading is conducted above the 30- and 50-day moving averages, indicating the pair's potential for further growth.

Note: The period and prices of the moving averages are considered by the author on the hourly H1 chart and differ from the general definition of classic daily moving averages on the daily D1 chart.

Bollinger Bands:

In case of a decline, the lower boundary of the indicator, around 1.2740, will act as support.

Description of Indicators:

- Moving average (defines the current trend by smoothing out volatility and noise). Period – 50. Marked in yellow on the chart;

- Moving average (defines the current trend by smoothing out volatility and noise). Period – 30. Marked in green on the chart;

- MACD (Moving Average Convergence/Divergence) Fast EMA – period 12. Slow EMA – period 26. SMA – period 9;

- Bollinger Bands. Period – 20;

- Non-commercial traders – speculators such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements;

- Long non-commercial positions represent the total long open position of non-commercial traders;

- Short non-commercial positions represent the total short open position of non-commercial traders;

- The total non-commercial net position is the difference between the short and long positions of non-commercial traders.