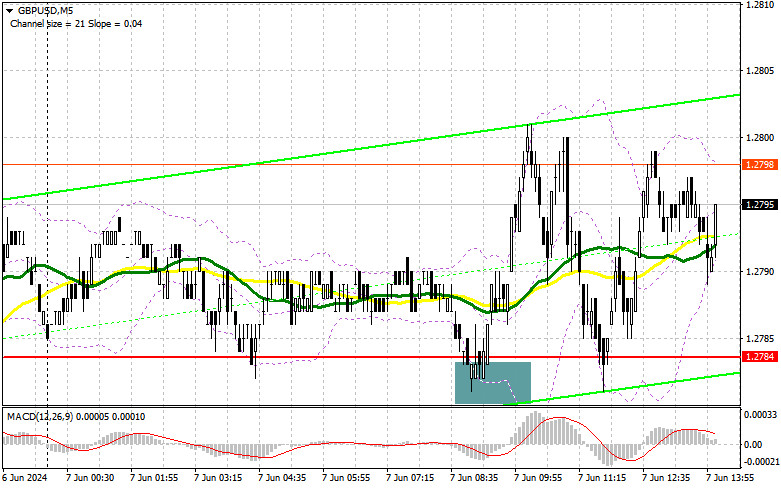

In my morning forecast, I paid attention to the 1.2784 level and planned to make decisions on entering the market from it. Let's look at the 5-minute chart and figure out what happened there. The decline and the formation of a false breakdown there led to a buy signal, but after moving up by 15 points, the pressure on the pound decreased. In the afternoon, the technical picture still needed to be revised.

To open long positions on GBP/USD, you need:

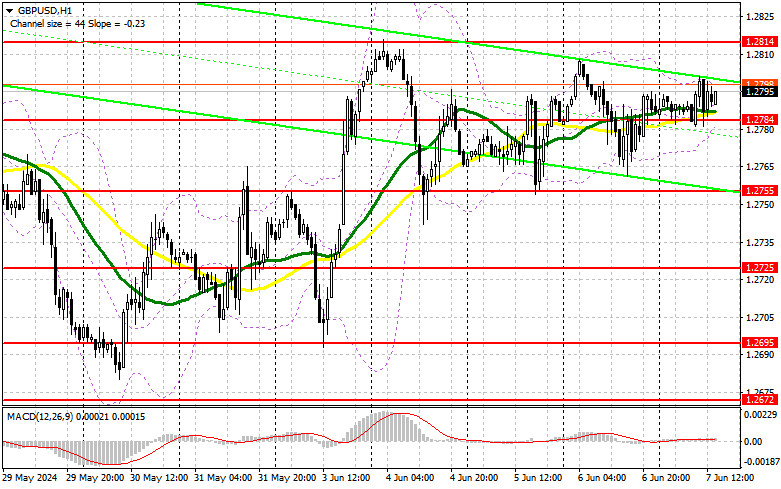

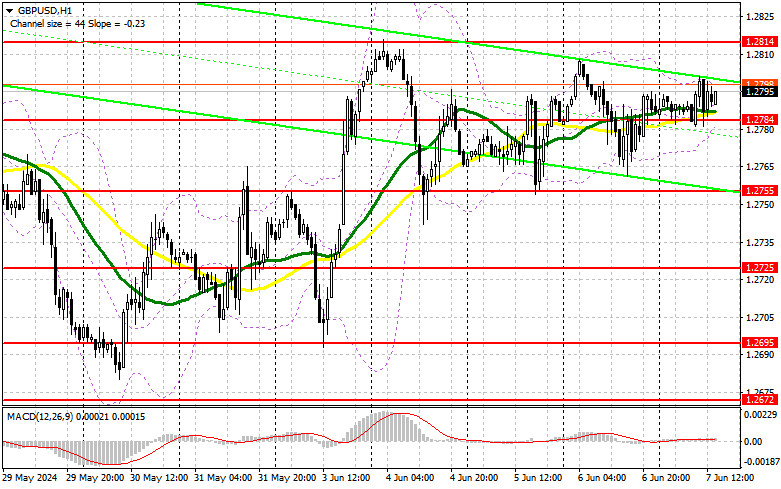

It all depends on the US data. In the event of another slowdown in the growth of new jobs, you can safely buy the pound and sell the dollar. If the data indicate a return to the stability of the labor market and an increase in the average salary of Americans, most likely, the pressure on the pair will return, and we will see a new sell-off at the end of the week. Given that the technical picture has not been revised, I'm going to act again after a false breakdown in the support area of 1.2784 by analogy with what I discussed above. There are also moving averages that play on the buyers' side. This will give an entry point into long positions in the expectation of a breakthrough and a reverse top-down test of the resistance of 1.2814, which we did not reach yesterday. Purchases there will certainly lead to an update of the next level of 1.2853, which acts as a monthly maximum. The farthest target will be the 1.2890 area, where I'm going to take profits. In the scenario of a decline in GBP/USD and a lack of activity on the part of the bulls at 1.2784 in the afternoon, the pressure on the pair will increase. This will also lead to a decrease and update of the next 1.2755 support. Only the formation of a false breakout will be a suitable condition for opening long positions. I'm going to buy GBP/USD immediately on a rebound from the 1.2725 minimum in order to correct by 30-35 points within the day.

To open short positions on GBP/USD, you need:

Sellers have tried, but so far, they have little connection with reality. The figures for the United States will likely determine everything, but without a breakdown of 1.2784, it is unlikely that anything will be done. If the pair grows, only the protection of the nearest resistance of 1.2814, together with the formation of a false breakdown there, will become the starting point for the entry to sell the pound in order to decrease to the area of 1.2784. A break in this range will deal another blow to the bulls' positions, leading to the demolition of stop orders and opening the way to 1.2755. The farthest target will be the 1.2725 area, where I will record profits. With the option of GBP/USD growth and lack of activity at 1.2814 in the afternoon, the development of the bull market will continue, and buyers will regain the initiative. In this case, I will postpone sales until a false breakdown at the level of 1.2853. In the absence of a downward movement there, I will sell GBP/USD immediately for a rebound from 1.2890, but I am only counting on a correction of the pair down by 30-35 points within the day.

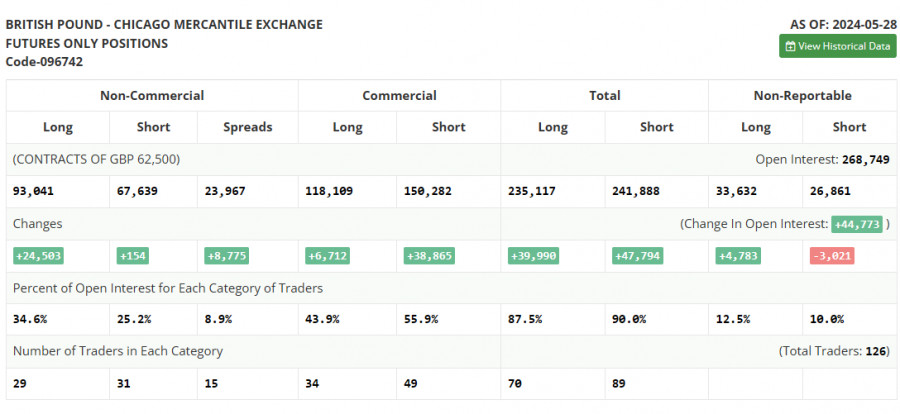

In the COT report (Commitment of Traders) for May 28, there was a sharp increase in long positions and a slight increase in short positions. Despite the fact that economists continue to believe that the Bank of England will cut interest rates by the end of the summer, the situation may change at any moment. The increase in price pressure that is currently being observed in the United States and the eurozone may become a problem area for the Bank of England on the way to easing monetary policy. Given that things are also not going well in the UK, especially with regard to inflation in the service sector, many market participants expect policy changes to be made later, which is reflected in the growth of the pound against the US dollar. The latest COT report says that long non-profit positions increased by 24,503 to 93,041, while short non-profit positions increased by only 154 to 67,639. As a result, the spread between long and short positions increased by 8,775.

Indicator Signals:

Moving Averages

Trading is conducted around the 30 and 50-day moving averages, indicating a sideways market.

Note: The period and prices of the moving averages are considered by the author on the H1 hourly chart and differ from the general definition of classical daily moving averages on the D1 daily chart.

Bollinger Bands

In case of a decline, the indicator's lower boundary, around 1.2780, will act as support.

Indicator Descriptions:

- Moving Average: Determines the current trend by smoothing out volatility and noise. Period: 50. Marked in yellow on the chart.

- Moving Average: Determines the current trend by smoothing out volatility and noise. Period: 30. Marked in green on the chart.

- MACD Indicator (Moving Average Convergence/Divergence): Fast EMA period: 12. Slow EMA period: 26. SMA period: 9.

- Bollinger Bands: Period: 20.

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions: Represent the total long open position of non-commercial traders.

- Short non-commercial positions: Represent the total short open position of non-commercial traders.

- Total non-commercial net position: The difference between short and long positions of non-commercial traders.